Doing business in Green County? We are here to help!

Whether you’re starting a new business, developing a new product, growing your current business, or selling it, Green County Development Corporation and our partners are committed to providing you with the best possible assistance.

We can connect you to the resources that will lead you in the right direction or guide you through to a solution that works for you and your business.

We can assist you with:

- Current economic, demographic & industry statistics, including community profiles & tax structures for communities within Green County

- Accessing local, state, and federal financial resources & incentives (Revolving load funds, tax credits, training grants, etc.)

- Site & building tours, briefings, & selection

- Referrals to service & economic development professionals who can offer free information & technical assistance

- Identifying permit & licensing agencies

- Coordination with transportation an utility companies within our communities

- Setting up personalized briefings & business meetings tailored to your specific needs

- Labor market, job training, & industry support resources

All communications are kept in confidence

Top Employers

Green County is home to many successful, large and small businesses. In addition to our many financial and retail employers, our top employers include healthcare providers, industrial manufacturing, and of course agriculture or food processing. We are proud of the diversity of businesses in Green County, and the level of employees we bring to them. We are successful together, we create quality lives and products, together!

DEMOGRAPHICS

37, 1602021 population |

43.42020 Median Age

|

||

15,495Total Households

|

74.7%Owner Occupied

|

3.8%2022 population of color

|

7.1%2021 Poverty Rate

|

Ground Transport1,263 miles of highway & 700 miles of track run through Green County, taking your your product where it needs to be! |

Air TransportMonroe Municipal Airport provides 3k & 5k feet of lighted, paved runways, charters and other needed amenities, all with close connection to national and international airports.

|

Ports & BargesWithin less than 2 hours you will find ports on the Mississippi River and Lake Michigan transporting globally.

|

Warehouse FacilitiesGreen County has multiple commercial warehouses,

including cold storage & freezer space. GCDC will connect you to the right storage solution!

|

WORKFORCE

59.98%population age 18-64

<18 = 23.1%

>64 = 16.9%

|

92.8%high school or higher education

24.5% bachelors degree or higher

|

||

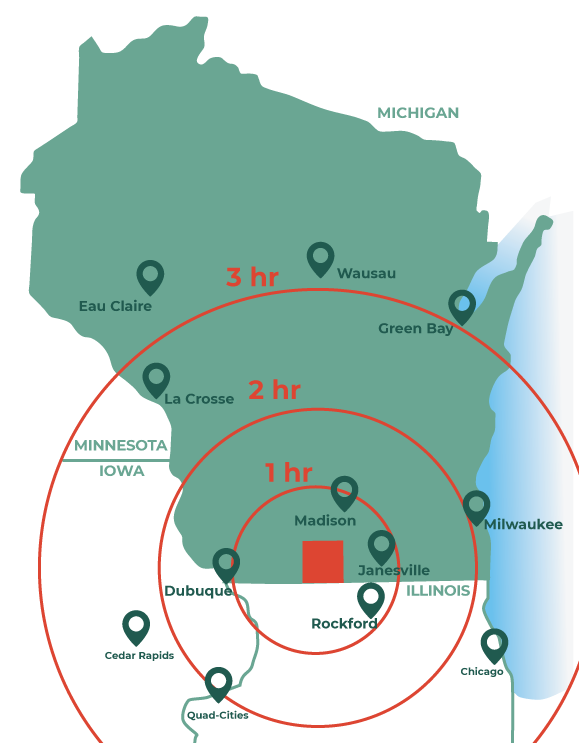

Population within the county> 36,000within 1-hour> 600,000

|

|||

$72,887Median Household Income, 2022

|

24.6min – avg commute

|

||

83%household broadband

|

|||

$615BProjected domestic trade by 2050 (68.3% increase) |

Top IndustryManufacturing 17.1%

Retail 13.9%

Health 13.3%

|

||

INCENTIVES

| Green County Growth Opportunity Fund (Revolving Loan Fund) | Need Funding to Start or Grow Your Business in Green County? GCDC is here to help. We are able to offer up to $100,000 per business for high growth start ups and emerging growth companies through our Growth Opportunity Fund. |

Download our Brochure for more details, then give us a call and let us help you! Download our Brochure for more details, then give us a call and let us help you!608-328-9452

|

|

Commercial Property Accessed Clean Energy (C-PACE) financing available through PACE Wisconsin. Affordable financing for energy improvements in commercial and industrial properties. Contact GCDC for more information 608-328-9452

|

Download the PACE fact sheet for more details, then give us a call and let us help you! Download the PACE fact sheet for more details, then give us a call and let us help you!608-328-9452

|

|

| Pop-Up Shops |

Partnering with private property owners in downtowns across the county to fill empty storefronts to create successful long-term, sustainable ventures. Give us a call and start your dream today! 608-328-9452 Landlord Pop-Up Shop Information

|

|

| Grants & Additional Funding Sources | GCDC continually works to obtain grants to support economic development efforts in our county. Over the past 5 years, we have been awarded over $500,000 in grant funds to support child care initiatives, broadband improvements, community kitchen, and entrepreneurial development. We are always ready for the next opportunity! |

ENTREPRENEURS

Southwest Wisconsin Small Business Development Center |

|

|

The Wisconsin Small Business Development Center (SBDC) partners with GCDC to support local entrepreneurs at any stage. They offer no-cost, confidential consulting and education to help you: Take the First Steps

Start Your Business

Grow Your Business

Finance Your Business |

|

USEFUL LINKS

Building & Sites

Green County offers some of the most affordably priced land and buildings in Wisconsin. GCDC is here to assist you in your search.

Search Commercial Properties in Green County, WI

For more information on any of the listed properties: EMAIL GCDC or call 608-328-9452

For more information on any of the listed properties: EMAIL GCDC or call 608-328-9452

Ready for the Next Steps?

GIVE US A CALL AND LET US HELP YOU BUILD A BUSINESS THAT THRIVES 608.328.9452

Ready for the Next Steps?

GIVE US A CALL AND LET US HELP YOU BUILD A BUSINESS THAT THRIVES 608.328.9452

PACE Wisconsin

PACE Wisconsin